Nvidia owns substantial positions in data center operator CoreWeave and semiconductor company Arm.

Better Artificial Intelligence Stock: Palantir vs. Advanced Micro Devices

These stocks are both highfliers, but one has the advantage.

OpenAI CEO Sam Altman’s stark warning: AI could bring ‘really bad stuff’ – The Times of India

Tech News News: OpenAI CEO Sam Altman warned of “really bad stuff” and “strange or scary moments” arising from AI, citing concerns over deepfake technology and societ

Israel playing catch-up in AI after two years of war

The country is a proven innovation hub with global reach in cybersecurity and defense technology, yet it has lagged in national-scale investment.

AI models are learning to stay alive, new study says some resist shutdown like they have instincts

A few weeks after the study was released, a new update has come to light. The update states that out of the leading AI models, Grok 4 and GPT-o3 were the most rebellious. Despite explicit commands to shut off, they still tried to interfere with the shutdown process.

Avatars, chatbots, robot church dog: How to steward AI at church

Spiritual leaders wrestle with where to draw the line on artificial intelligence — and how it will affect their own spiritual practices and the well-being of their faith communities.

When AI Meets Gaming: Hype, Chaos, and the Future We Can't Ignore

For today’s daily dose of the internet, let’s have a quick look at AI in gaming, and there’s no better way to start than with one of the latest viral clips…

I tried ChatGPT's Atlas browser to rival Google – here's what I found

OpenAI hopes to upend the browser market currently dominated by Google Chrome, but it depends on paid users.

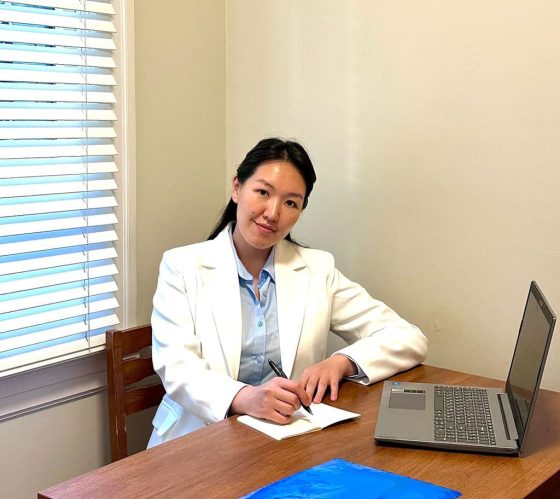

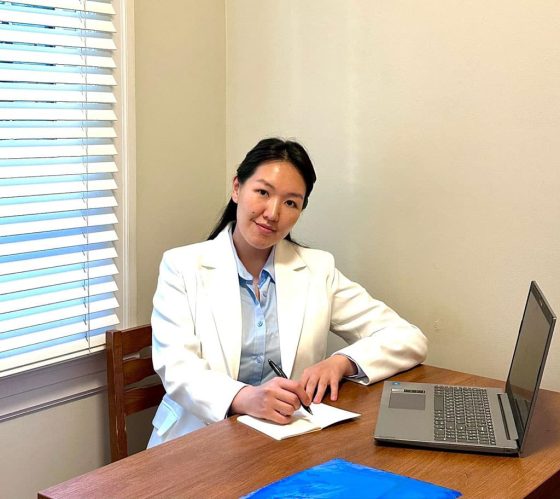

🩺 AI Revolutionizes Vascular Surgery: Daria Baldanova’s Insights

At ACC 2025, Daria Baldanova discussed AI’s transformative role in vascular care. The study highlighted innovative algorithms enhancing surgical precision and patient outcomes, particularly in the U.S. Medical professionals are leveraging machine learning models for predictive analysis and improved diagnostics, marking a significant shift in surgical methodologies.

Read More:

When Surgery Meets Artificial Intelligence: A New Era in Vascular Care – Meet Daria Baldanova

At the annual session of the American College of Cardiology (ACC 2025), a study was presented showing that the use of AI systems in cardiac ultrasound allows even novice specialists to obtain diagnostic-quality images. This opens new horizons for widespread access to vascular diagnostics. We spoke with Darya Baldanova about why precise diagnostics are so important […]